The main thing to keep in mind when selling a business is the same thing you need to keep in mind with whatever you are selling what is the buyer looking for? You get nowhere when you focus on what you want from your buyer; but you can get what you want if you focus on what your buyer might want from you.

The basic conundrum is that, here you are you have a business, and you want to improve your position by converting it to cash. On the other hand, there is a prospective buyer, he has cash, and he wants to improve his position by converting it into a business hopefully yours.

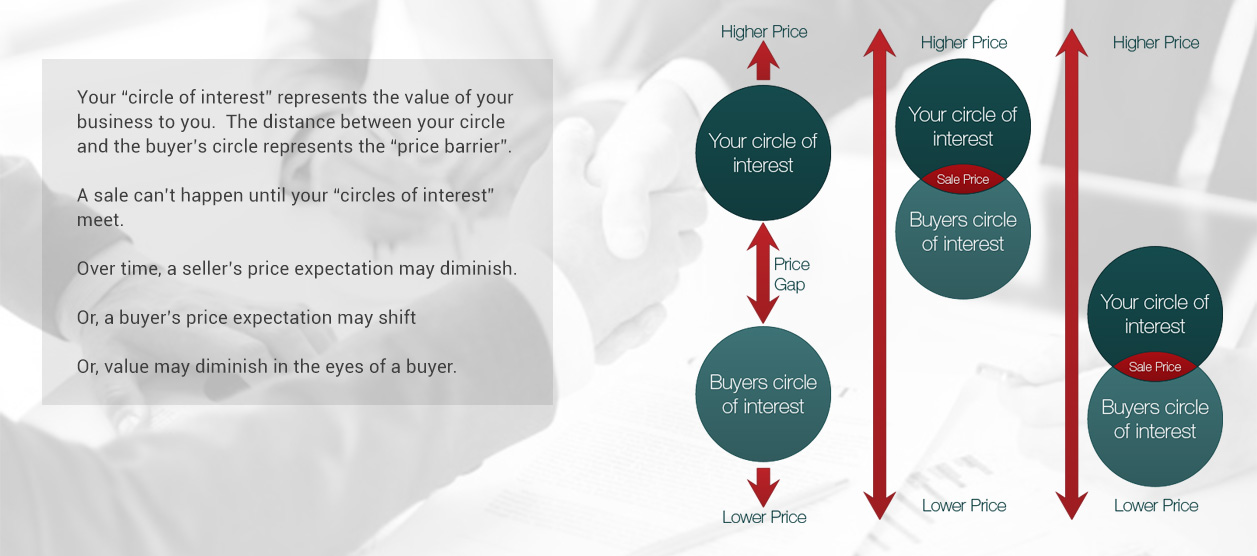

Your œCircle of Interest represents the value of your business to you, and the distance between your circle, and the buyer's circle, the œPrice Barrier, is the difference between your perception of the value of your business, and the buyer's perception of its value. A sale can't happen until your œcircles of interest meet.

You might start off with a very high value on your business, but your price expectation eventually diminishes (your circle moves to the right, towards the buyer's circle), due to such factors as:

You want to retire

You are sick of this business

Changes in family or partnership circumstances

Frustration at working too hard

Difficulties raising capital to fund further growth

You are offered sufficient price which, combined with any combination of the above, motivates you to part with your business

The buyer's œCircle of Interest represents his accumulated wealth, and all the effort that has gone into raising it, along with his very real fears of losing it.

His interests will move closer to your interests (Circle move to the left) when his fears of losing his money are outweighed by confidence factors to an extent where he will begin seeing positive value in your business.

The factors that might shift his perception of the value of your business closer to yours might include:

Synergies with his own business

Wanting to build on your client base

Wanting to acquire new technology

Reliable and attractive profit figures

Experienced personnel

On the other hand, the factors that might shift his perception away from yours might include:

The perception that your business requires too much of your personal involvement

Lack of systems which would enable a new owner to œslot readily in

Unreliable profit figures

Insecurity about your suppliers or customers, or position in the marketplace.

For a sale to eventuate your two circles of interest must eventually meet, at a point where his perception of the value of your business meets your minimum requirement for compensation for all the effort you have put into building up your business.

Whether you have to move further to meet the buyer, or the buyer can be persuaded to meet you, depends upon how much evidence you can produce, to justify your position. The greatest barrier to getting the buyer interested in your business is their fear of losing their money. The best way to prove to them the value of your business, to the extent that they will pay your price, is to give them confidence in their ability to make a success of it.

They know very little about your business, so it is up to you to prove these things. The way to do this is through evidence.

With brokers in Sydney, Melbourne, Adelaide and Brisbane, Lloyds will help you achieve your goals.

Read about setting a realistic asking price.

Read about preparing for sale.