Selling a business can be a time consuming and complicated process. Many business owners choose to work with a business broker to help them navigate what can often be a complex and stressful period of time. Business Brokers are professionals who specialize in buying and selling businesses, providing advice based on years of experience, providing support and a range of services to help you sell your business more efficiently and for the best price.

Using a broker also comes with costs, which can be a significant factor in your decision of whether to use one or not. In this article, we'll compare the costs of selling a business with and without a broker, so you can make an informed decision.

All of these terms need to be negotiated as part of the structure of the deal. An oversight or wrongly negotiated term can prove to be a costly mistake. It helps to have an experienced broker negotiating in your corner.

While brokers provide valuable assistance in selling your business, all brokers charge for their services. The most common way brokers are paid is through an upfront marketing contribution and then a commission (a percentage of the sale price) once the sale contract has been executed. The exact percentage varies between brokers and deal sizes, but it is typical in the industry for the commission to be between 5% and 10% of the sale price.

In addition to the commission, brokers may also quote additional fees for optional services such as additional marketing initiatives and once-off appraisals. These fees can vary significantly depending on the complexity of the sale and the services required.

If you're considering not using a broker, we highly recommend that you obtain quotes from brokers anyway so that you know what your saving will be. This will allow you to make an informed decision either way.

I remember a friend of mine who lived in Sydney Australia. Let's call him Dave. Dave decided to sell his small tech startup on his own without enlisting the help of a business broker. Dave was a savvy Aussie entrepreneur, confident in his abilities to navigate the sale process himself. I offered some advice, but he was determined to go it alone.

Initially, things seemed to be going well for Dave. He managed to generate some interest in his business and even had a few promising meetings with potential buyers. However, as the negotiations progressed, problems started to arise. One major issue was the lack of a solid confidentiality agreement. Without the guidance of a broker or legal expert, Dave underestimated the importance of protecting sensitive information about his business. Unfortunately, this led to leaks of proprietary data, causing concerns among potential buyers and ultimately scaring off some of the most serious contenders. Another challenge Dave faced was in the valuation of his business.

Despite his best efforts, he struggled to accurately assess the value of his startup. He did not factor in how valuation multiples vary by industry. This led to unrealistic expectations on his part. This resulted in protracted negotiations and eventually, stalled deals as buyers were unwilling to meet his inflated asking price. Without the support of a broker to facilitate communication and mediate negotiations, tensions between Dave and potential buyers often escalated unnecessarily. Misunderstandings arose, and trust eroded, making it even more difficult to reach mutually beneficial agreements. In the end, Dave realized that selling his business without a broker was more challenging and time-consuming than he had anticipated.

He eventually decided to enlist the help of Lloyds to salvage the sale process and ensure a smoother transaction. Reflecting on Dave's experience, I've seen firsthand the pitfalls of trying to sell a business without the expertise and guidance of a seasoned sydney based business broker. It's a complex process that requires careful planning, strategic thinking, and a deep understanding of market dynamics. While going it alone may seem like a cost-saving measure, the potential risks and headaches far outweigh any perceived benefits.

Alternatives to Using a Broker

If you decide that the cost of using a broker is not right for you, there are some potential alternatives to consider.

To help you compare the costs of using a broker versus alternatives, here are two fictional scenarios to consider.

Scenario 1:

John Smith is a retiring baby boomer who wants to sell to the next generation. John believes his business should be valued at approximately $2 million. To avoid commission and fees he heads down the path of selling the business himself via his personal network of contacts. After 6 months of paperwork, negotiations and meetings John is able to find a buyer for his business. After another 2 months of legal paperwork and review, the contract of sale is signed and John settlement is executed.

John is happy that he saved approximately $100,000 of commission and fees, but he believes that he made several important concessions in the terms of the sale. For years after, John wonders whether using a business broker would have resulted in a better negotiated deal.

Scenario 2:

John Smith contacts a business broker to value and sell his business. He agrees to a 5% commission with $10,000 of upfront marketing fees. The business broker values his business at $2.2 million. After 4 months of marketing, meetings and negotiations on John's behalf, the broker has found 3 prospective buyers for John's business. Over the next 2 months, John and his broker meet with the prospective buyers to see which would be the best fit and offer the best price. 1 of the 3 buyers turns out to not be suitable. The other 2 buyers are eager to proceed with the sale. The broker plays the buyers off each other to secure a premium sale price of $2.4 million.

The broker receives a commission of $120,000 (plus the $10,000 upfront marketing fee). John is happy to receive the remaining proceeds of $2.28 million. A price that exceeded his original expectations. John knows the broker negotiated aggressively to get him the best price and terms possible.

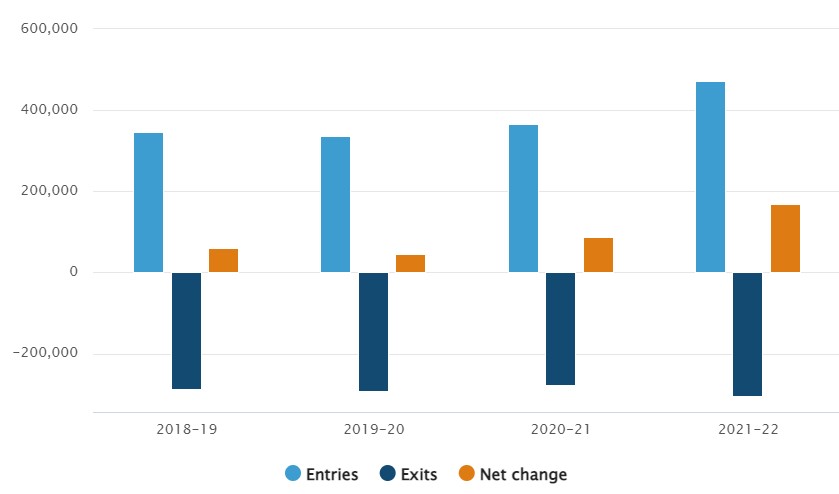

According to the Australian Bureau of Statistics, between 2018 - 2022, Australia experienced an average annual turnover of business entry and entries of 12% - 19%. Many of these businesses were sold using a broker.

Australian business entries and exists (2018 - 2022)

Source: Australian Bureau of Statistics

A business broker will help you sell your business by providing guidance in the following areas:

There are pros and cons to using a business broker when selling your business. Brokers can provide valuable assistance with finding buyers, negotiating terms, achieving the best sale price and handling administrative tasks. Brokers do charge a commission and often marketing fees. If you decide that the cost of using a broker is not right for you, there are alternatives to consider, such as selling the business yourself or working with an accountant, business transfer specialist or lawyer.

As the above 2 scenarios demonstrate, avoiding commission does not necessary leave you with more money at the end of the sale.